Banks have to build a dynamic digital customer experience to drive loyalty and carry on their business. Along with solutions like document scanning services, the banking industry is also relying on e-signature to digitize and automate their operations. The adoption of e-signatures into banking processes will deliver significant and quantifiable outcomes in terms of reduction in costs, speed of transaction completion, and increased customer satisfaction. It often happens that many banking transactions such as loan approvals, account openings and investments take more time due to the stringent requirements of customer signatures.

Adopting e-signatures (electronic signatures) for such transactions will deliver significant and quantifiable outcomes in terms of reduction in cost, speed of transaction completion, and increased customer satisfaction.

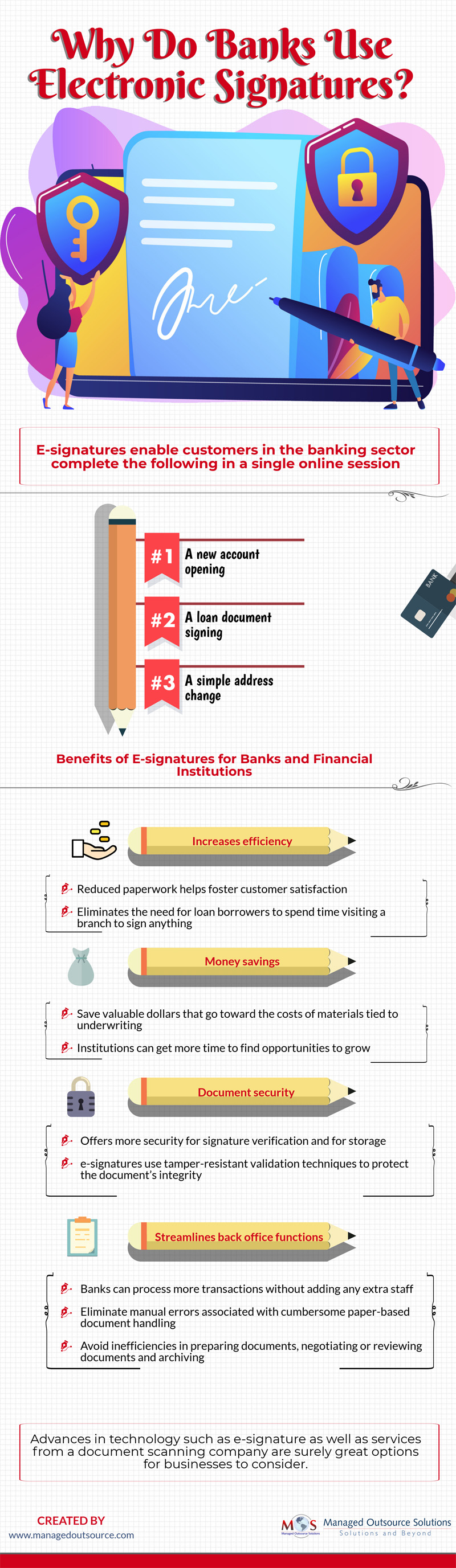

Read the infographic to understand the other benefits offered.