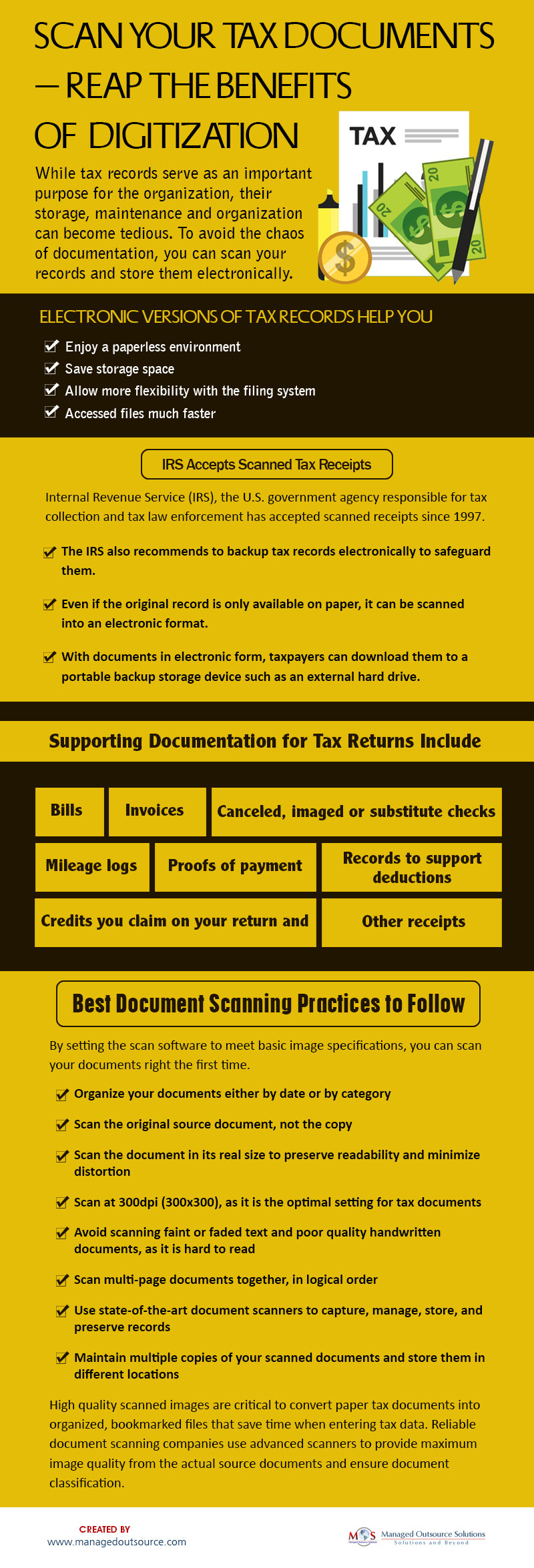

Often taxpayers have to keep their paper tax records for three years or more following the date of filing or the due date of their tax return. Those necessary tax records and other financial documents kept in boxes in a storage room somewhere, is of course difficult to access. Several reports show that finding, organizing, and entering tax data consumed almost 50 percent of the total time of tax professionals. An ideal solution is to scan and store these documents in a legible, readable digital format.

You just need to ensure that your scanned or electronic receipts are as accurate as your paper records and you must be able to index, store, preserve, retrieve, and reproduce the records. With services offered by established document scanning companies, tax professionals can recognize the potential productivity gains available with scanning. Important tax documents can be scanned as digital PDF files and stored on a computer.