A financial audit is a useful tool for controlling financial risks, establishing trust with stakeholders, making sure a company complies with legal and regulatory obligations, and upholding transparency in the firm’s financial operations. Digital financial records can make audits and regulatory evaluations easier. Digital records are easier for auditors to access and evaluate, which improves audit efficiency and minimizes disruption to ongoing business operations. Large volumes of financial documents can be easily digitized using document scanning services.

Importance of Financial Audits

Financial audits are essential to help businesses function effectively, and improve performance and operational processes. Powered by technology and innovation, the audit has evolved into a strategic opportunity that helps inform future business decisions.

Financial audits are not just a compliance exercise; they also present an opportunity to gain knowledge. A survey of 300 executives and 100 audits committee members by Deloitte’s US audit practice revealed that:

- Approximately 79 percent of executives and 91 percent of audit committee members agree that financial statement audits identify opportunities to improve business performance.

- Almost half (46 percent) of executives and even more audit committee members (62%) say it’s at least somewhat likely that they would have missed important insights if the audit had not occurred.

- Companies that regularly capitalize on information received from the audit are more likely to have achieved growth over the past three to five years.

Financial audits help companies to learn new information about their industry and market, discover shortcomings in processes and policies and identify inefficiencies and risks. Increased use of data analytics is helping auditors to manage a much larger volume of relevant data, improving risk analysis and increasing investor confidence.

Despite the awareness of the value of audits, many companies still miss out on the opportunities an audit provides to improve their business. According to Deloitte’s survey, one in three companies rarely or never leverages the information received from their financial statement audits. Almost half of the executives said their companies don’t always use information from their audits and do not have processes in place to make use of the insights from the audit.

Auditors and their clients have room for improvement by unlocking the full potential of the audit. Up to 79 percent of the executives and 94 percent of audit committee members asserted that making financial statement audit findings more transparent within their organization would improve their company performance.

The following techniques can be used by auditors, management and audit committees to ensure that the client derives maximum value from the audit.

- Communication: The communication between management, audit committees and auditors will help ensure that the company is aware of taking advantage of the insights that auditors discover. They can be sure that their insights have been understood clearly.

- Train auditors on judgement and communication: The team should continue to work on improving skills so that they can deliver well and have the ability to communicate effectively, and also take analytics and innovations and share it with the audit committees.

- In-depth planning with auditor and management: Improve auditor-management collaboration by sharing valuable information throughout audit planning to ensure success. Management has a thorough awareness of its business and the environment in which it operates, and can provide insights on risks and important developments that have occurred throughout the year. A meeting of preparation with the auditors prior to the audit enables information sharing and discussion of timelines.

Although many business leaders recognize the expansive value of today’s financial statement audits, many still do not realize its full impact.

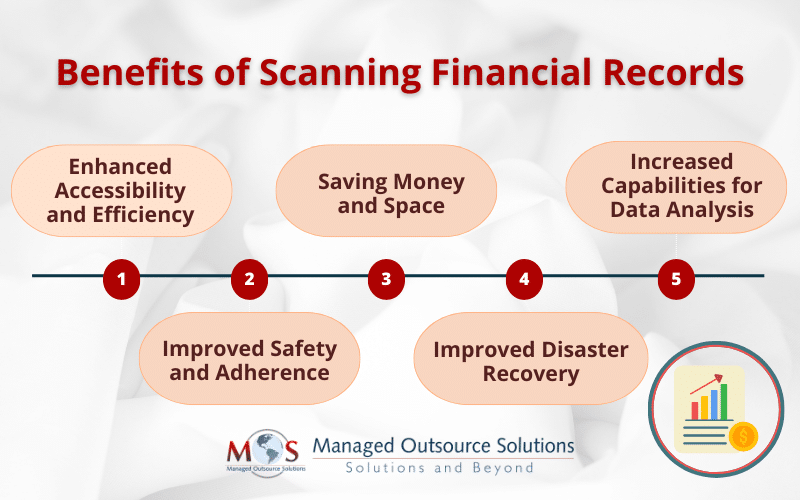

Advantages of Scanning Financial Documents

Digitizing financial papers is advantageous for a variety of reasons. These are but a handful:

- Enhanced Accessibility and Efficiency: Text-based searches can be used to access digital materials, saving time compared to looking through physical files. Given that financial documents may be safely accessed or shared from any place, firms with remote teams or various locations will find this nearly instantaneous access advantageous.

- Improved Safety and Adherence: Digital files are less likely to be lost, stolen, or damaged since they are readily encrypted, password-protected, and kept in safe cloud locations. The process of scanning financial documents is created with adherence to strict privacy rules and regulations, guaranteeing that private financial information is handled and preserved appropriately.

- Saving Money and Space: By switching to digital recordkeeping, you can save money on filing cabinets, storage rooms, and the maintenance of these areas by reducing the requirement for physical storage space. A digital system saves money on paper and printing expenses by reducing the need for physical copies.

- Disaster Recovery: Digital backups ensure that important financial documents are not lost forever in case of any unfortunate case of a physical calamity such as a fire or flood. This adds a safety and ease level that is difficult to obtain with only physical record-keeping.

- Increased Capabilities for Data Analysis: Digital financial records facilitate advanced data analysis. Businesses can monitor performance, assess financial trends, and make data-driven choices in real time utilizing a range of tools with digital data.

Read our blog

Top Trends for Financial Document Management Systems

Financial audits improve the reliability and accuracy of a company’s financial reporting. Digital transformation the help of data conversion services can make financial auditing easier.

Ready to streamline your financial audits?

Get started with our document scanning services.