Optical Character Recognition (OCR) technology captures information from scanned or image-based textual documents like PDFs and transforms it into text that can be edited, formatted, and queried by machines. The implementation of OCR-based technologies has significantly enhanced the efficiency of business process outsourcing services within the financial industry, automating data extraction and validation processes.

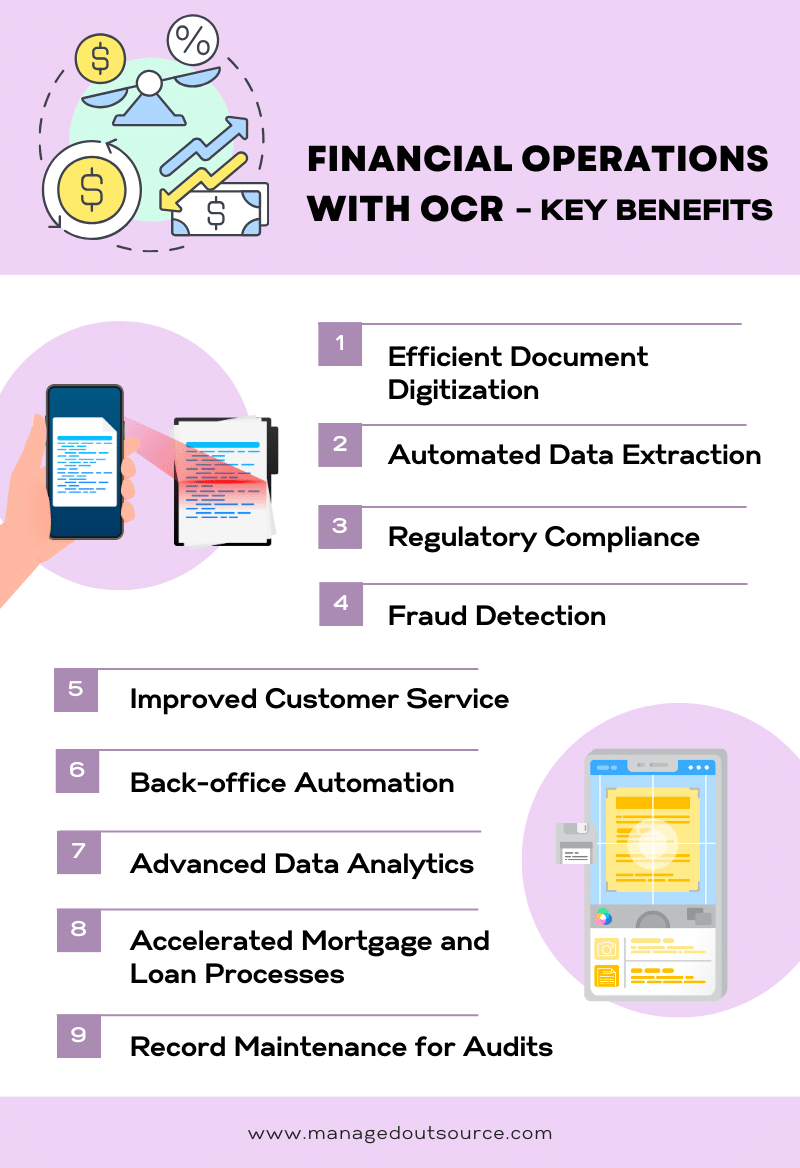

OCR Technology Use and Benefits

- OCR helps financial institutions digitize vast amounts of paper-based documents, making it easier to manage and retrieve critical information. This has streamlined processes like account on-boarding, loan applications, and document verification, reducing manual data entry and human errors.

- OCR technology extracts text and numerical data from documents, allowing for the automated extraction of key information from invoices, receipts, contracts, and financial statements. This data can then be validated against existing records or used to update databases, reducing the risk of data entry errors.

- OCR plays a crucial role in ensuring compliance with regulatory requirements. By automatically extracting data from financial documents, institutions can more easily generate reports required by regulatory authorities. This reduces the time and effort needed to comply with regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

- OCR-based technologies can help in identifying potential fraudulent activities by analyzing large volumes of transactional data and financial documents. Suspicious patterns and discrepancies can be flagged for further investigation, enhancing fraud detection capabilities.

- OCR-enabled chatbots and virtual assistants can improve customer service by quickly retrieving customer information and answering queries. This improves response times and enhances customer engagement in areas like account balance inquiries, transaction history, and loan status updates.

- OCR automation can be applied to various back-office operations, such as data entry, data validation, and document categorization. This leads to cost savings, increased efficiency, and reduced operational errors.

- Access to structured data from OCR-processed documents enables financial institutions to perform more advanced data analytics. They can gain deeper insights into customer behavior, risk assessment, and market trends, which can inform decision-making processes.

- OCR technology expedites the mortgage and loan application process by automating the extraction and verification of applicant information from various documents. This accelerates the approval process and improves the customer experience.

- OCR helps financial organizations maintain accurate records for audit and risk management purposes. It allows auditors to easily review documents and transactions, reducing the time and effort required for compliance audits.

Overall, OCR-based technologies can significantly reduce operational costs by automating repetitive tasks and reducing the need for manual data entry and document handling.

What Are the Major Financial Documents?

Financial records, commonly referred to as financial documents, serve as a means to present a company’s financial data in a consistent and structured manner.

Some examples of these standardized financial documents include:

- Invoices and Purchase Orders

- Balance Sheet

- Checks and Bank Statements

- Profit and Loss Statement

- Pay Slips

- Tax Forms

OCR technology enables the conversion of numerous paper-based documents, regardless of their languages and formats, into machine-readable text. This not only streamlines storage but also grants accessibility to previously unreachable content with just a single click.

OCR Technology Use in the Corporate and Financial Sectors

The most common and widespread uses of OCR in the financial sector includes document scanning, credit card scanning, data entry, and various other applications.

Financial documents can be categorized into three main types:

A) Documents with Structured Data

B) Documents with Semi-structured Data

C) Documents with Unstructured Data

Structured Data Document Processing & OCR Technology

A structured data document is one that possesses discernible elements suitable for effective analysis. It has been organized into a structured repository, often referred to as a database, and typically resembles data stored within a SQL database in the format of a table with rows and columns. These documents incorporate relational keys and can be easily matched with predefined fields.

OCR’s operation in processing structured data documents typically involves a three-stage algorithm:

- The initial phase focuses on identifying tables and recognizing individual cells using OpenCV.

- Subsequently, there is a meticulous assignment of each cell to its corresponding row and column.

- Finally, OCR is employed to extract the content from each allocated cell, converting it into machine-readable text

Effective cell identification relies on the presence of clear and discernible lines. Tables characterized by fragmented lines, interruptions, or gaps can lead to diminished recognition accuracy, and cells partially enclosed by lines are often overlooked by the algorithm. In cases where documents exhibit broken lines, data extraction may be compromised, but this challenge can potentially be addressed through data processing methods.

Semi-structured Data Document Processing & OCR Technology

Semi-structured data is information that deviates from traditional recording and preparation methods. It doesn’t conform to the structured format of tabular data models or relational databases due to the absence of a fixed schema. Nevertheless, semi-structured data is not entirely raw or disorganized; it possesses certain structural attributes like tags and organizational cues that facilitate easier analysis. Examples of semi-structured documents include P&L statements, IRS Forms, Acord Forms, Bank statements, and Invoices.

The location of crucial identifiers and checkboxes within semi-structured forms can differ based on the data fields, posing a challenge for template-based OCR software, as it may result in the extraction of inaccurate data from different page locations.

To ascertain the ‘position information’ for a data point, data extraction from semi-structured forms relies on the application of business rules. These rules are founded on the assumption that the extracted data consistently occupies a specific relative position relative to a defining feature.

Unstructured Data Documents & OCR Technology

Unstructured data/documents are precisely what the term implies – information presented in an unrestricted layout, lacking a predefined structure. Contrary to what one might expect, unstructured content is not necessarily limited to physical documents; it can still be captured using today’s advanced OCR capture algorithms. This unstructured data can be found in agreements, articles, letters, memos, and various other forms of written material.

The Information Extraction (IE) process involves the extraction of structured information, including entities, relationships, objects, and events, from unstructured data. This extracted information is then employed to prepare data for analysis, enhancing the efficiency and accuracy of data analysis.

IE on unstructured data involves the integration of various Natural Language Processing (NLP) techniques, including Named Entity Recognition (NER), Relation Extraction (RE), Event Extraction (EE), and the extraction of significant facts. These established techniques can be utilized for subsequent analysis.

Advantages of Optical Character Recognition (OCR) for Financial Paperwork

- It reduces the need for manual retyping

One of the most valuable aspects of utilizing OCR software is its ability to save a significant amount of time previously spent on manual data entry. For instance, consider a scenario where you had created a text document for an invoice, but it was lost due to an operating system crash or accidental deletion.

- Streamlines document editing

OCR also simplifies the process of editing documents, even those that have been previously printed or exist in a fixed PDF format. Even if you possess hard copies, there may be certain documents that require editing.

- Enhances digital searchability

If you maintain scanned documents or invoices on your computer, it is advisable to run them through OCR software first. This not only facilitates content modification but also makes the documents searchable.

OCR-based technologies have revolutionized the financial industry by enhancing efficiency, accuracy, compliance, and customer service. They have become integral tools for financial institutions looking to stay competitive, reduce costs, and adapt to evolving regulatory and market demands.

Consider our data processing services to streamline your business documentation.