Accurate and efficient data entry services are crucial for maintaining a well-organized accounting system. However, data entry challenges can hinder the smooth operation of accounting processes. In this blog post, we will explore effective tips to overcome data entry challenges in accounting and ensure accurate financial record-keeping. Some of the key challenges faced by the accounting sector when it comes to manual data entry are – significant room for error, inability to deal with a surge in work, and the considerable time involved.

By automating data entry, accountants can free up time to focus on more valuable and strategic tasks, leveraging their expertise and contributing to business growth. The major negative outcomes that organizations face due to such challenges include incorrect business strategy, increased financial costs, missed opportunities, and damaged reputation. Inaccurate financial information erodes trust, potentially leading to lost clients, negative reviews, and reputational damage that can be challenging to recover from.

Automation in the form of robotic process automation (RPA) or artificial intelligence (AI), and Optical Character Recognition (OCR) can be used in accounting to minimize the errors and challenges in data entry. Implementing robust data validation processes, providing training to improve accuracy, and establishing internal controls can also help reduce the risks associated with manual data entry.

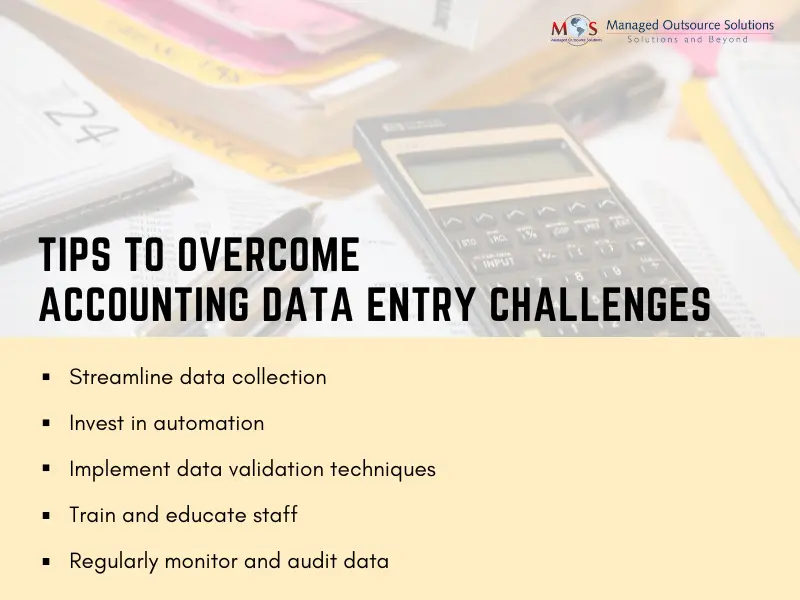

How to Overcome Data Entry Challenges in Accounting

Effective data entry is vital for maintaining accurate financial records and ensuring the smooth functioning of accounting processes. By streamlining data collection, embracing automation, implementing data validation techniques, providing proper training, and conducting regular audits, you can overcome data entry challenges in accounting. Implement these tips to enhance accuracy, efficiency, and reliability in your accounting practices, ultimately leading to better financial management and decision-making.

By leveraging data entry companies, businesses can effectively manage their accounts and maintain a robust information database. This plays a crucial role by helping to make informed decisions and by fostering growth.