In today’s fast-paced business environment, accurate and efficient data management is crucial, particularly in industries like finance and law. These sectors handle a large amount of sensitive and complex information daily, making data entry a cornerstone of their operational processes. Regarded as an essential part of any law firm’s operations, the process involves entering, processing, storing, and retrieving various types of data, such as legal documents, case files, client information, transaction histories and more. However, data entry can also be challenging and time-consuming. It requires a high level of attention to detail, accuracy, and speed, as well as compliance with legal standards and regulations. Moreover, data entry can divert valuable time and resources from core tasks that require the expertise and skills of legal and financial professionals. Therefore, it is crucial for businesses to streamline their processes and maximize efficiency. This is where data entry services become relevant. Leveraging professional outsourcing services can help streamline operations and significantly enhance efficiency, accuracy, and compliance, ensuring smooth business processes.

Challenges in Data Entry for Financial and Legal Firms

Managing data for financial and legal firms presents several challenges that can affect the efficiency and effectiveness of services rendered. Some of the common challenges include –

- Volume and Complexity – Financial and legal data can be complex and diverse, and comprise different types of information, formats, sources, and languages. Moreover, the data may constantly change, as it can be updated, modified, or deleted according to the progress and outcome of financial and legal cases. The volume and complexity of data make the process daunting and tedious. It may also increase the risk of errors, inconsistencies, and duplication of data, and thus compromise data quality and reliability.

- Time-intensive – Data entry for financial and law firms requires a lot of manual work such as scanning, typing, copying, pasting, formatting, and verifying data. It also involves multiple steps, such as collecting, organizing, categorizing, indexing, and archiving data. The time-intensive nature may also distract the attention and focus of professionals from core legal and financial tasks that require their expertise and skills, such as researching, analyzing, litigating, drafting, and negotiating.

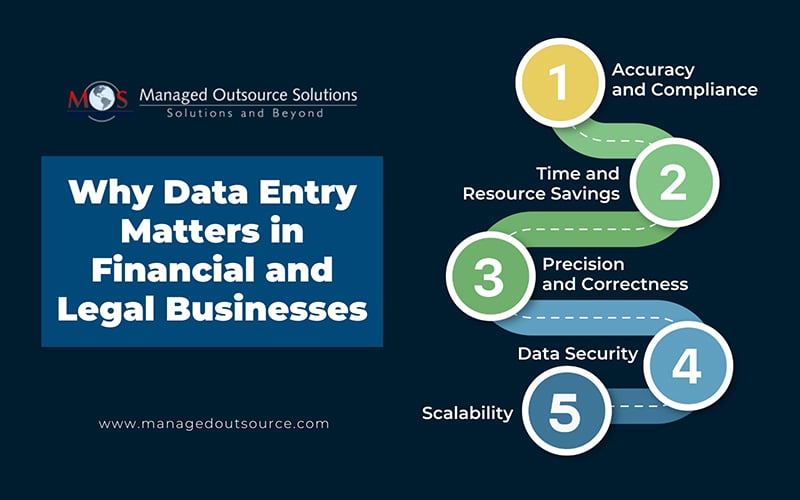

Why Data Entry Matters in Financial and Legal Businesses

- Accuracy and Compliance – Financial and legal documents such as contracts, tax records, and case files must be error-free. Errors in data can lead to legal disputes, financial losses, and compliance issues. Professional companies ensure high levels of accuracy, reducing the risk of mistakes.

- Time and Resource Savings – Legal and financial industries often face tight deadlines. Manual processes can be time-consuming and prone to delays. Outsourcing solutions allow businesses to focus on core tasks while experienced professionals handle the processing efficiently. Specialized solutions can save time and resources for these firms. They can reduce the manual work and the number of steps involved. They can also increase the speed and efficiency, as they can process large volumes and varieties of data in a short time. By saving time and resources, specialized data entry solutions enable financial and legal professionals to focus on other core tasks that require their expertise. They also help improve the productivity and profitability of legal and financial firms, by handling more cases and clients in less time.

- Precision and Correctness – Specialized data management service providers use advanced technologies, such as optical character recognition (OCR), natural language processing (NLP), artificial intelligence (AI), and machine learning (ML) to automate and optimize data entry. In addition, they use excellent quality control measures such as data validation, verification, and correction to detect and eliminate errors, inconsistency, and duplication of data.

- Data Security – Secure data management processes are vital to protect client confidentiality and adhere to industry regulations. Reliable service providers implement stringent security measures to safeguard information.

- Scalability – Businesses in finance and law often experience fluctuating workloads. Outsourcing provides the flexibility to scale operations up or down as needed, ensuring resources are utilized optimally.

Benefits of Legal Data Entry Services

Legal data entry services play a pivotal role in streamlining operations for law firms and legal departments. These services include –

- Case Management – Organizing and digitizing case files for easy access and retrieval.

- Document Processing – Inputting contracts, legal forms, and court documents into secure systems.

- Compliance Management – Ensuring accurate recording of regulatory requirements to avoid penalties.

- E-Discovery Support – Assisting in the electronic discovery process by cataloging and indexing data.

Outsourcing legal data entry ensures that legal entities maintain meticulous records while focusing on delivering quality legal representation.

Benefits of Financial Data Entry Services

Financial institutions such as banks, investment firms, and insurance companies also benefit immensely from outsourcing services. These benefits include –

- Enhanced Data Analysis – Accurate data handling lays the foundation for effective data analysis, which is critical for financial forecasting and decision-making.

- Regulatory Compliance – Financial data must comply with stringent regulations. Outsourcing ensures that all records are maintained in accordance with industry standards and legal mandates.

- Improved Customer Experience – Timely and accurate data management enhances customer service, as clients receive prompt and error-free responses to their queries.

The Role of Data Entry Outsourcing Services

Outsourcing these tasks to specialized providers offers numerous advantages-

- Cost Efficiency – Maintaining an in-house team can be costly, considering training, and maintaining infrastructure. Outsourcing eliminates these overheads, allowing businesses to access expert services at a fraction of the cost.

- Expertise and Specialization – Professional companies employ trained personnel with expertise in handling financial and legal data. This specialization ensures adherence to industry-specific standards and requirements.

- Faster Turnaround Times – Outsourcing providers are equipped with advanced tools and technologies, enabling faster data processing without compromising accuracy. This efficiency is especially beneficial for businesses with high-volume data needs.

- Focus on Core Activities – By outsourcing, financial and legal firms can redirect their internal resources toward strategic and revenue-generating activities, such as client advisory and case preparation.

Accurate and efficient data management is vital for financial and legal organizations. By outsourcing it to a professional data entry company, organizations can achieve greater accuracy, compliance, and scalability. Whether through legal/financial data entry services or comprehensive outsourcing solutions, investing in expert support ensures that businesses remain agile and competitive in a data-driven world. By partnering with an experienced service allows to transform data management processes, and focus on core objectives with confidence.

Ensure accuracy in legal and financial processes with our data entry services!