Adopting new technologies is now essential not just for survival but for thriving in the digital age. However, businesses need to strategically leverage technology to improve operational efficiency, promote innovation, and deliver outstanding customer experiences. Document digitization services utilize cutting-edge scanning and optical character recognition (OCR) technologies to transform physical documents into highly searchable, shareable digital files.

To transform your business into a digital organization, you must digitize your cash cycle. Automating your accounts receivable (AR) and payment processes will make your business more efficient, competitive, and profitable. Eliminating paper documents is the first step towards achieving digital accessibility and flexibility. With paper-based forms, you may not be aware about an error until you receive a monthly report. When forms are digitized, the data is easily and instantly accessible, allowing you to take prompt action to correct it. Let’s start off with the steps in the digitization process.

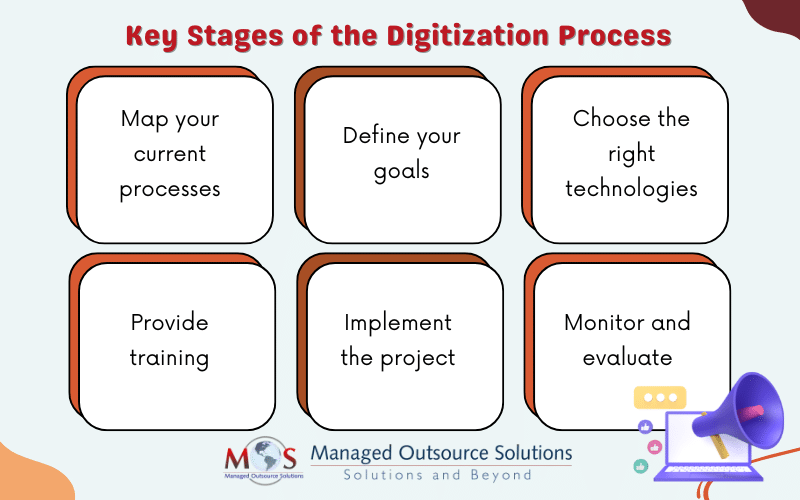

Stages in the Digitization Process

The digitization process involves several steps:

- Map your current processes: First, analyze your current processes to get a clear insight of how they work. Use document management software or project management tool to get a comprehensive view of your organization’s ongoing activities. This can drive better coordination and cohesion.

- Define your goals: Set clear digitalization goals based on what your company wants to achieve. Assess the feasibility of each goal as well as if your company has the technical capabilities to implement them.

- Choose the right technologies: There are different types of technologies out there and you should choose the option that will help you achieve your objectives. Invest in software that has cloud-based storage, reporting and analytics. A business process management (BPM) system would be the right choice to optimize digital workflows, while a human resources management system (HRMS) is the way to go if you’re digitizing HR operations. Automating accounts receivable (AR) processes using the right software can reduce errors and save time and money.

- Provide training: Your teams need to have specialized skills in order to adapt to new technologies. Provide training and support, while making sure your employees understand the benefits of digitization. Pay attention to their ideas and feedback o the process.

- Implement the project: Start with digitizing low-risk activities that will cause minimal organizational disruption. Once this gains momentum and succeeds, move on to gradually digitize more complex tasks.

- Monitor and evaluate: Monitoring the digitization process and supporting your team at every stage is essential for success.

Once documents have been scanned, they need to be sorted, named, classified and time-stamped. Optical character recognition (OCR) scanning services use OCR software to identify typed text within digital images and convert it into usable digital text. Creating fully searchable metadata will make your archive easily discoverable. Documents should be stored in an easily understandable hierarchy with sensitive information are secured using access restrictions or encryption.

Now that we’ve discussed the steps involved in digitizing a business’s organizational processes, we dive specifically into the digitization of accounts receivable.

Digitizing AR Processes is a Game Changer

Digitization of your business cycle and specifically the AR process can prove a game changer. Automating the AR process includes automating invoice generation, payment processing, and cash application/reconciliation.

Invoicing

Invoice processing relies on accounts payable. The conventional method involves creating paper invoices by entering invoice data, purchase order matching, and endless filing. Automated invoice processing does away with this bloated process by using software to generate and send invoices electronically to customers. The software streamlinex the invoicing process using automated reminders, online payment options, and digital signatures. By integrating your invoicing system with your accounting software, automation ensures seamless data transfer and record-keeping.

Payment processing

To implement digitizing payment processing, you need to evaluate all of the payment options your business offers and eliminate manual tasks as far as possible. Implementing digital payment options allow customers to pay invoices securely online using credit/debit cards, e-wallets, or bank transfers. Offering a variety of digital payment options can improve the customer experience and improve cash flow.

Reconciliation

Automating account reconciliations streamline the process of matching your organization’s general ledger and its respective financial statements with external financial statements, like bank accounts and credit cards. Advanced software pulls data from your financial statements and compares it with external data sources, such as bank statements. This reduces the need for manual data entry and significantly improves accuracy.

Benefits of AR Automation

Technology to digitize business cash cycle processes is more flexible than ever before. If you are wondering why AR automation is indispensable, here are some solid reasons.

- Improves cash flow and reduces DSO (Days Sales Outstanding)

- Minimizes manual data entry and errors

- Enhances the customer experience through self-service portals

- Provides better visibility and control over the AR process

- Eliminates repetitive tasks and enables your team to focus on strategic initiatives

While AR automation focuses on digitizing specific processes such as invoice generation, payment processing, and cash application/reconciliation, business cycle automation digitizes and connects multiple functional areas to create a more efficient and data-driven organization.

Today, the journey towards digitization is more accessible than ever due to the availability of flexible and scalable digital technologies. By leveraging these options, businesses can improve their operations, enhance customer experiences, and identify new opportunities for growth. And for those looking to accelerate their digital transformation, partnering with experienced business process outsourcing companies can make a big difference. Experts can help organizations overcome the complexities of digitization, implement the right technologies, and optimize their business processes. With the right blend of flexible technology and expert guidance, any business can navigate the challenges of digitization and thrive in the digital landscape.

Take the first step towards streamlining your business processes!