Starting a small business is an exciting journey filled with potential and promise. However, there are several crucial things to consider before launching your venture. From crafting a solid business plan to understanding market needs and managing finance, each step requires careful thought and strategic planning. How you go about these matters can significantly impact your venture’s outcome. There are significant challenges that you can expect to face along the way. The good news is that external support is available in the form of business process outsourcing services to help you tackle specific areas and complete work with greater accuracy and speed.

In this post, we discuss the key considerations when launching a small business, and offer insights and practical tips to help you navigate the complexities successfully.

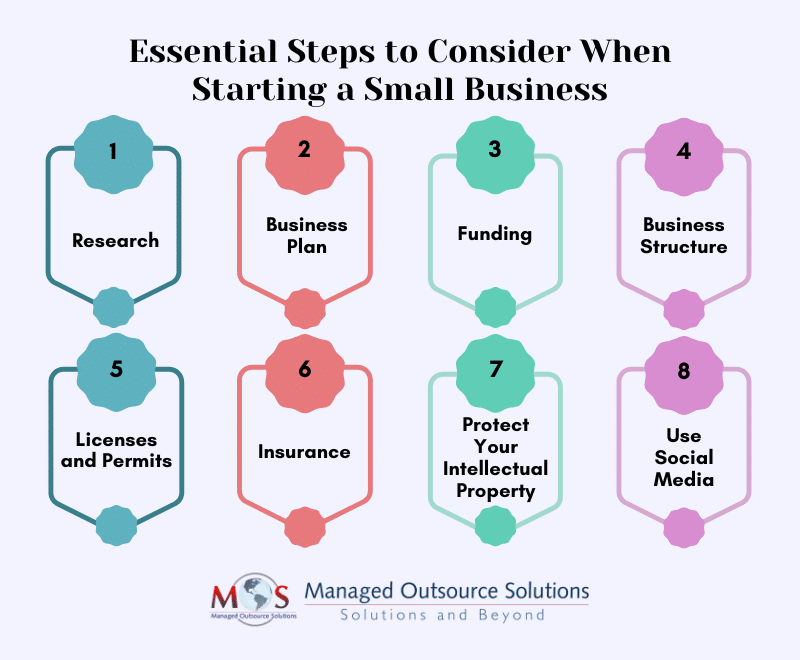

Basic Considerations when Starting a Small Business

Whether you’re in the early stages of planning or ready to make a start, these considerations can guide you toward building a thriving and sustainable business.

Research

Research the market, competitors, and location. Market research can help you make better decisions about your business and avoid mistakes. As the first step, gauge the demand for your service or product by conducting surveys, interviews, focus groups, and so on. This will help you understand how you can position them in the best way and make them stand out.

Understand your customers and where they live and work. This can help you choose a location that they can easily access. Researching your audience will also allow you to segment them into groups, based on gender, age, tastes, etc., and send out personalized marketing messages.

Next, research your competition: where your competitors are, including their strengths and weaknesses.

Learn from your competition: understand what your competitors are doing and how they reach out to their target audience. This information will help you develop strategies that are better than theirs.

Business Plan

Once you’ve done your research, create a business plan. A business plan is a road map or blueprint that defines your business. It should outline your business strategy, goals or where your business is headed, and how you plan to reach those goals. Make sure to set SMART (Specific, Measurable, Achievable, Relevant, Time bound) goals.

Create an operational plan for your day-to-day tasks. This will help you assign tasks to your team. A business plan also includes financial details, like how much money you’ll need and how you’ll make money. Outline your long-term vision in your business plan, covering your long-term goals and the key steps to reach those goals.

Your business plan should also have a marketing plan on which marketing channels to use, strategies and budget. A well-crafted marketing plan enables you to effectively allocate time, money, and resources to reach the right audience. There are two primary market sectors: Business to Consumer (B2C) and Business to Business (B2B). Experiment with both sectors to determine which generates a better response. Gathering feedback from respondents—such as their age group, reasons for their interest, and how they discovered your business—will help you gain valuable insights into your target market and understand what attracts your customers.

Funding

Once you have your plan on paper, think about finance. The average cost to start a small business and run it for the first full year is $40,000, according to a recent article from Homebase. Every business has unique needs, and there’s no universal financial solution.

Here are several funding options available for small businesses:

- Self-funding or bootstrapping: Many small businesses start by using personal funds. You can raise capital from family and friends, use savings, or tap into your 401(k). However, this approach carries significant financial risk, especially if your funding needs are substantial.

- Small business loans: If you want to maintain full control but lack sufficient funds, consider a loan. When applying, be prepared with your business plan and personal financial statements. Once your materials are ready, approach banks and credit unions, and compare offers for the best terms.

- Small business grants: Grants offer funding that doesn’t need to be repaid. While researching and applying for grants can be time-consuming, successfully securing one can be highly beneficial.

- Crowdfunding: This method allows you to gather funds from many individuals.

Business Structure

Deciding on a business structure is a crucial decision for your small venture, as it affects legal liability, taxes, and operational flexibility. Options to consider include sole proprietorship, partnership, Limited Liability Company (LCC), corporation and cooperative. To choose a structure, evaluate your business goals, financial situation, and maximum level of risk you are willing to take on. Consulting with a financial advisor can help you make an informed decision on your business structure.

Licenses and Permits

Regardless of the type of business you set up, you’ll need a business license. Contact your local government offices or the Small Business Administration (SBA) to check about any licenses or permits your business will need. Essential licenses for your business include a general business license, which permits operations within your local jurisdiction, and a professional license if you provide specialized services, such as daycare or legal advice. Depending on local regulations, additional permits may be required, such as health and safety permits, a sign permit for advertising, and a sales tax license,.

Insurance

Consider business insurance to protect your small venture from various risks. While general liability insurance protects against bodily injury, property damage and personal injury, property insurance covers damage to your property. Other options include professional liability insurance to protect against claims of negligence, errors or omission and Workers Compensation insurance to cover med expenses and lost wages for employees injured on the job.

Protect Your Intellectual Property

Trademark your business name to safeguard your brand. If you’re selling a product, consider patenting it to prevent others from registering a patent for the same invention after your business launches.

Use Social Media

With over 4 billion daily active users, social media marketing is crucial for small businesses. Start by defining how social media can benefit your business and developing content that aligns with industry trends to attract potential customers. Focus on creating quality content that provides value rather than just promoting sales. This approach will boost your online credibility, position your business as an industry expert, and help grow your social media following.

Leverage Business Process Outsourcing Services

A 2021 Harvard Business Review article noted that despite unprecedented challenges, many small to medium-sized businesses (SMBs) around the world have shown remarkable resilience and capacity to reinvent themselves. Start small and expand gradually. Remember that external support is available to help you overcome any challenges, both initial and long-term. Outsourcing is a practical strategy to manage back office functions like accounting, customer service, answering calls and emails, etc. Partnering with a business process outsourcing company can be cheaper than hiring and training an in-house team. Small businesses can pay only for what they need, when they need it, and avoid employee and office space overheads. Additionally, outsourcing non-core activities allows your team to focus on core business processes that drive growth, like marketing, product development, and sales.

Take the first step towards efficiency with reliable business process outsourcing services!